Table of Contents

- What Are the Elements of a Bond Price?

- The Types of Cash Flows Generated By a Coupon Bond

- Accrued Interest

- Day Count Conventions

- Clean Price vs. Dirty Price

- How to Calculate the Present Values of the Bond's Future Cash Flows

- Introducing the Formula for Calculating the Present Values of Bond Cash Flows

- How Different Types of Bonds Are Quoted in the Market

- Types of Bonds That Are Quoted in Price

- Types of Bonds That Are Quoted in Yield

What Are the Elements of a Bond Price?

The price of a bond can be defined as the sum of the present values of all the future cash flows the bond is expected to generate.

The present value of each cash flow is obtained by discounting. The interest rate at which the cash flow is discounted is the bond's current yield to maturity (YTM).

The bond price is expressed as a percentage of the bond’s face value. So, when someone purchases a certain face amount of a bond, that face amount must be multiplied by the bond price in order to obtain the amount of money the buyer actually has to pay.

The Types of Cash Flows Generated By a Coupon Bond

A coupon bond typically produces two categories of cash flows, namely coupon payments throughout its lifespan and principal repayment upon maturity.

Depending on the type of bond and the market where the bond is issued, the coupon frequency of a bond may differ. The most common coupon frequencies are annual and semi-annual, but bonds with quarterly or even monthly interest payments also exist.

To illustrate this, let us look at an actual bond. We will use a German government bond, commonly referred to as "Bundesanleihe" or "Bund". This bond offers a 0.50% annual coupon, has a redemption price of 100%, and reaches maturity on February 15th, 2028 (ISIN: DE0001102440).

The ensuing table exhibits the future cash flows to be paid as of today (June 12th, 2023) by the bond issuer, i.e. the German Government, to the bondholder throughout the tenure of the bond.

| Date of Cash Flow | Cash Flow Type | Cash Flow |

| 15/02/2024 | Coupon | 0.500% |

| 15/02/2025 | Coupon | 0.500% |

| 15/02/2026 | Coupon | 0.500% |

| 15/02/2027 | Coupon | 0.500% |

| 15/02/2028 | Coupon+Face Amount | 100.500% |

The figure above shows cash flows derived from annual coupon payments of 0.500% of the bond's face value. At maturity, the ultimate coupon payment is augmented by the reimbursement of the bond's principal, which is 100% of the face value, resulting in a cash flow of 100.500% for the final year.

Accrued Interest

The term accrued interest designates the interest that is due to the holder of a bond but has not yet been paid. This amount accrues on a daily basis from one coupon payment date to the next, until it reaches zero when the next coupon is paid.

Day Count Conventions

Day count conventions refer to the method used to determine the number of days between two dates for the purpose of interest calculation or discounting.

The choice of day count convention can vary by country, market, and bond type.

It affects how interest accrues and is calculated during the period between coupon payment dates. Different day count conventions may assume different numbers of days in a year or month, taking into account factors like leap years or the varying lengths of months.

The specific convention used for a bond should be specified in the bond's prospectus or offering documents.

There are several commonly used day count conventions, including:

- Actual/Actual (Act/Act): This convention calculates the actual number of days between two coupon payment dates and divides it by the actual number of days in a year. This method is considered the most accurate and is used for most government bonds.

- Actual/360 (A/360): This convention calculates the actual number of days between two coupon payment dates and divides it by 360. It assumes a 360-day year, with each month consisting of 30 days. This method is commonly used for money market instruments and corporate bonds.

- Actual/365 (Act/365): This convention calculates the actual number of days between two coupon payment dates and divides it by 365. Actual/365 is most commonly used when pricing U.S. government Treasury bonds.

- 30/360: This convention assumes a 360-day year and divides each month into 30 days. It counts the number of days between two coupon payment dates as a multiple of 30. This day count convention is commonly used for calculating interest accrued on corporate bonds, municipal bonds, and agency bonds in the U.S.

Clean Price vs. Dirty Price

It is important to distinguish between a bond's clean price and its dirty price while discussing bond prices. The accrued interest is the sole difference between the two values. The dirty price of a bond comprises accrued interest, whereas the clean price does not. Typically, price-quoted bonds are quoted using the clean price.

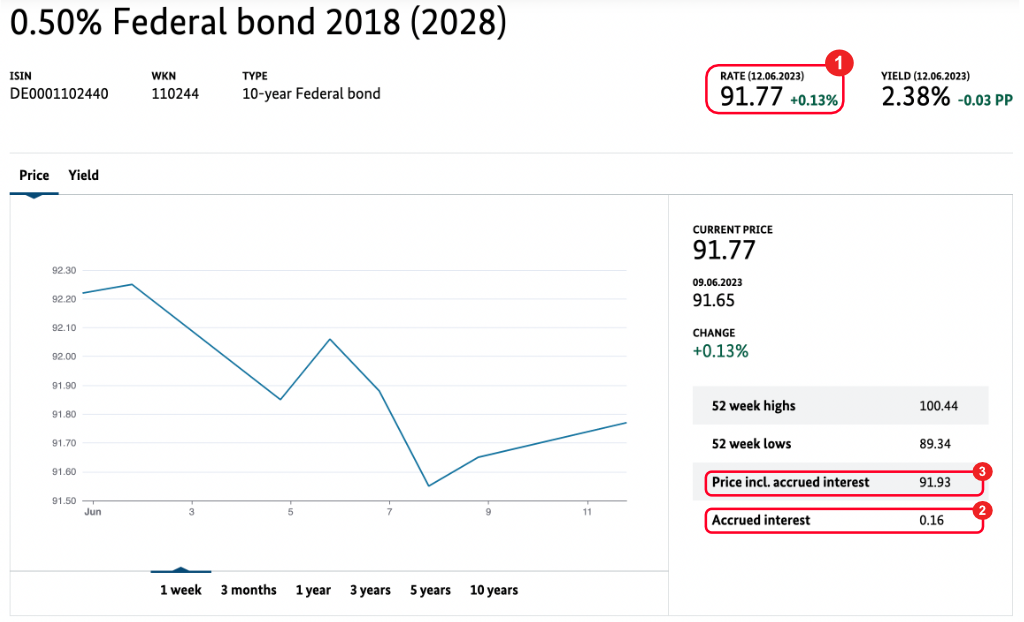

In the screenshot above you will see a representation of the two price concepts. The price of 91.77% labeled (1) is the bond’s clean price. If you add the accrued interest (2) of 0.16%, you will arrive at the bond’s dirty price of 91.93% (3) labeled “Price incl. accrued interest” in the illustration above.

How to Calculate the Present Values of the Bond's Future Cash Flows

As mentioned above, the present value of the bond's future cash flows is calculated by discounting. The interest rate used for discounting is the bond’s yield to maturity (YTM) of the bond.

The market convention is that all future cash flows are discounted at the same rate, even though coupon payments and the repayment of the bond’s principal occur at different moments in the future.

While this facilitates financial modeling, it does not really reflect economic reality, as it is obvious that a given amount of money cannot be borrowed for one year and five years at the same interest rate. This however is exactly what discounting all cash flows using the same interest rate implies.

Introducing the Formula for Calculating the Present Values of Bond Cash Flows

The formula used to determine the present value of the upcoming cash streams from the bond is:

$$NPV = \sum_{n=1}^{N} \frac{C_{n}}{(1+i)^{t_{n}}}+ \frac{P_{N}}{(1+i)^{t_{N}}}$$

The result of this equation provides us with the gross price, as it includes the current coupon in its entirety, and does not account for any accrued interest.

The gross price of the bond is, therefore, the sum of the present values of the cash flows resulting from the future coupon payments (C) and the repayment of the nominal value (P), each discounted by the yield (i) over the period t, which - for each cash flow - is the period between the calculation date (i.e. the value date) and the payment date of the respective cash flow, expressed in years and year fractions.

We will now apply this equation to our German government bond, in order to calculate first the gross price, and then the clean price. We will use the yield of 2.38% indicated in the quote above, and use the same calculation date as the screenshot.

The date indicated in brackets next to both the price and the yield (June 12th, 2023) is the date of the quote, and will be our calculation date.

Before starting the price calculation, we’ll quickly recapitulate the necessary information and make some preliminary calculations.

Bond data

Coupon rate: 0.500%

Maturity date: February 15th, 2028

Yield to maturity (YTM): 2.38%

Day count convention: Actual/Actual

Preliminary calculations:

Accrued interest days (15/02/2023 to 12/06/2023): 117

Days to next coupon (12/06/2023 to 15/02/2024): 248

Year fraction: 0.67945 ( = 248/365)

With this information, we can proceed with the calculation of the bond price:

| Date of Cash Flow | Cash Flow | Discount Period (in years) | Discount Rate | Discounted Cash Flow |

| 15/02/2024 | 0.500% | 0.67945 | 2.380% | 0.4921% |

| 15/02/2025 | 0.500% | 1.67945 | 2.380% | 0.4806% |

| 15/02/2026 | 0.500% | 2.67945 | 2.380% | 0.4695% |

| 15/02/2027 | 0.500% | 3.67945 | 2.380% | 0.4585% |

| 15/02/2028 | 0.500% | 4.67945 | 2.380% | 90.0254% |

| Total | 91.9261% | |||

So the gross price of our bond results as 91.9261%, or 91.93% if rounded down to two decimals.

In order to obtain the clean price, we first need to compute the accrued interest amount that we will need to subtract. For this, we will multiply the coupon rate of 0.500% by the number of accrued interest days (117) and divide it by the days in the coupon period (365): 0.500% x (117/365) = 0.16027%

How Different Types of Bonds Are Quoted in the Market

In the overwhelming majority of cases, bonds are quoted either at their clean price or at their yield to maturity (YTM). However, occasionally other forms of quotation may be used. The type of bond determines which method is the standard in its market.

Types of Bonds That Are Quoted in Price

In the category of price quotes for bonds, we will find the current market prices of medium- and long-term coupon bonds. Whether classified as investment-grade corporate bonds, junk bonds or government bonds, their market quotations are typically denoted in price, expressed as a percentage of the bond's face value.

Types of Bonds That Are Quoted in Yield

Zero-coupon bonds, discount bonds and short-term bonds with a remaining term of less than one year, on the other hand, are generally quoted with their yield to maturity (YTM).

However, this is only a convention between market participants. As we will see later, a bond price can easily be converted into a yield to maturity and vice versa.

The relationship between bond price and bond yield

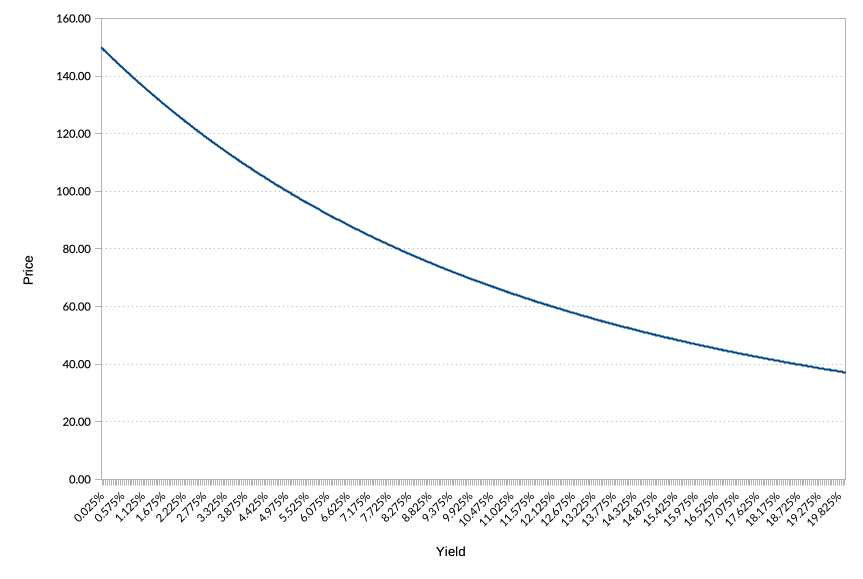

By looking at the formula used to calculate a bond’s price, one can see that bond price and the bond yield are inversely correlated: The higher the bond's yield, the lower its price, and vice versa. Below is a graphical representation of the relationship using a 10-year bond with a 5% coupon rate:

Note: The bond will quote at 100.00% of its par value (one also uses the expression “at par”) when the bond's yield-to-maturity has the same value as the bond's coupon rate.