Table of Contents

- Introduction

- The Relationship Between Bond Yield and Bond Price (Reminder)

- What Are the Characteristics of a Bond That Impact its Risk Profile

- The Quality of the Bond Issuer's Signature

- The Bond's Remaining Maturity

- The Bond's Coupon Rate and Coupon Type

- The Liquidity of the Bond in the Market

- Non-standard Characteristics of Bonds

- Embedded Options

- Subordination or Seniority of the Bond Issue

- Measuring interest rate risk

- The Duration of the Bond

- What is the Duration of a Bond?

- How is the Duration of a Bond calculated?

- What are the Factors that Influence a Bond's Duration?

- How to Interpret a Bond's Duration

- The Modified Duration of a Bond

- What is the Modified Duration of a Bond?

- How is the Modified Duration of a Bond Calculated?

- What are the Factors that Influence a Bond's Modified Duration?

- The Convexity of a Bond

- What is the Convexity of a Bond?

- What are the Characteristics of a Bond's Convexity?

- How is the Convexity of a Bond Calculated?

- What are the Applications for the Convexity of a Bond?

- The Price Value of a Basis Point (PVBP)

- What is the Price Value of a Basis Point (PVBP)?

- How is the Price Value of a Basis Point (PVBP) Calculated?

- Conclusion

Introduction

The Relationship Between Bond Yield and Bond Price (Reminder)

In the context of this article, it is important to remember that a bond’s price and yield are inversely correlated. The price of a coupon-bearing bond can be calculated using the following formula:

Point on the formula to see its legend

When a bond’s yield rises, be it for example because its issuer has been downgraded by a rating agency or due to a general rise in interest rates, its price will fall, and vice versa.

A rising yield will thus generate a latent loss on the bond position, a falling yield will result in a latent profit.

Characteristics of a bond having an impact on its riskiness

The Quality of the Bond Issuer’s Signature

If the rating degrades during the lifetime of a bond, the yield demanded by investors will rise which will, mechanically, cause the bond’s price to fall.

The Bond's Remaining Maturity

The further in the future a bond’s maturity lies, the riskier an investment it is. Firstly, its credit risk is higher because the longer a bonds remaining lifetime is, the higher the probability is that an unfavorable event takes place. Secondly, longer bonds have a higher interest rate sensitivity, which means that their price will show stronger reactions to variations in interest rates than shorter bonds.

To illustrate this, let us compare two bonds which both have a coupon of 6% and a yield which is also at 6%. The two bonds have maturities of 20 years and 5 years respectively. Yield being equal to the coupon rate, both securities will quote at 100% of nominal.

If the yield rises to 6.5% for both, the price of the 20-year bond will quote at 94.45, that is a fall of 5.55 percentage points. The same movement in yield will make the price of the 5-year bond fall to 97.89, a variation of only 2.11 percentage points.

The Bond's Coupon Rate and Coupon Type

All other things being equal, a bond with a lower coupon rate will show a higher sensitivity to variations in interest rates than a bond with a higher coupon rate. Due to this propriety, zero coupon bonds show the highest level of interest rate sensitivity.

Let’s take for example two bonds with a 20 year maturity, a 6% yield and coupon rates of 10% and 5% respectively. At this yield level, the price of the two bonds will be 145.88 for the 10%-coupon bond, and 88.53 for the 5%-coupon bond.

If the yield rises by 50 basis points to 6.5%, the price of the bond with the 10% coupon will fall 7.32 percentage points to 138.56, whereas the 5%-coupon bond will only quote 5.06 percentage points lower at 83.47.

The Liquidity of the Bond in the Market

The liquidity of a bond is another factor which will influence its price. Liquidity mainly depends on the availability of bonds for trading, i.e. the volume of the issue. Liquidity is a characteristic that usually does not change over time unless the initial issue is increased by the issue of additional, fungible tranches.

In order to accept buying a bond with low liquidity, the investor will demand a higher yield in order to compensate for the liquidity risk. This required surplus in yield is called liquidity premium.

Non-standard Characteristics of Bonds

Embedded Options

In some cases, bonds are issued with options included. The presence of options also impacts the way a bond’s price behaves. The value of the option, which needs to be taken into account for the calculation of the bond price, may reduce or increase price movements, or make them evolve in the opposite direction compared to a bond that has no options embedded.

That is the case for example for bonds with an option allowing the issuer to make an early redemption. In order to calculate the price of a bond presenting such an option, one has to deduce the value of the option, which benefits the issuer, from the price the bond would have if it did not have that option.

We have seen earlier that, if interest rates go down, the price of a bond goes up. The value of the option, however, rises as well, as it becomes more interesting for the issuer to replace the bond with a new issue for which he would have to pay less interest. The increase in the price of the bond would, therefore, be reduced by the value of the option.

Subordination or Seniority of the Bond Issue

Certain bonds are issued as subordinate securities, which means that in case of the issuer defaulting, they would rank behind ordinary, unsubordinated bonds when it comes to paying back investors. Their redemption will thus come after that of holders of ordinary bonds. To make up for that additional risk, subordinated bonds, which have a lower rating than ordinary securities from the same issuer, will pay a higher yield.

Measuring interest rate risk

In the absence of any particular event, a bond’s yield follows the general movements of interest rates. If interest rates fall, the bonds’ yields will follow that movement, however to varying degrees .

In order to determine the degree to which a particular bond is exposed to interest rate risk, different measures can be used, which will be explained below.

The Duration of the Bond

What is the Duration of a Bond?

Duration, which is also sometimes referred to as Macaulay duration, measures the weighted average time to reception for each of the cash flows (coupons and principal) generated by a bond and is expressed in years. Duration also provides an approximation of the percent value of the price change for a bond following a yield variation of 100 basis points, or 1%.

How is the Duration of a Bond calculated?

Duration is calculated as the sum of the present values of each cash flow multiplied by the time to payment, and dividing the result by the bond's dirty price.

Formula for the calculation of duration:

Point on the formula to see its legend

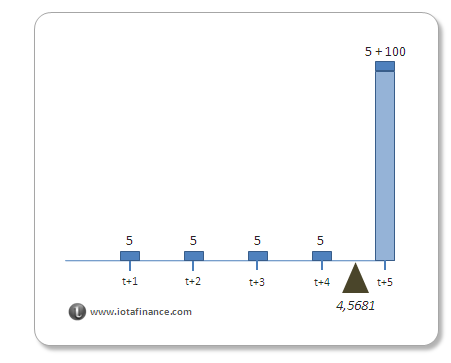

Example:

Let's take a bond with a remaining lifetime of 5 years and a coupon rate of 5%. At a yield of 3%, its price is 109.1594.

| Cash flow | Time (to payment) | PV | PV * Time |

| 5.000 | 1 | 4.8544 | 4.85437 |

| 5.000 | 2 | 4.7130 | 9.42596 |

| 5.000 | 3 | 4.5757 | 13.72713 |

| 5.000 | 4 | 4.4424 | 17.76974 |

| 105.000 | 5 | 90.5739 | 452.86961 |

| 109.1594 | 498.64681 |

Duration = 498.64681 / 109.1594 = 4.56806

If the bond's yield goes down to 2%, a fall of 100 basis points, its price establishes at 114.1404. In case of a rise by 100 basis points, the price would fall to 104.4518. Calculating the average of both price variations, we obtain :

( (109.1594 – 104.4518) + (114.1404-109.1594) ) / 2 = 4.8443, which is rather close to the estimation provided by duration.

Note: The duration of zero-coupon bonds is equal to its remaining maturity, as this type of securities does not generate any cash flow before its final maturity.

What are the Factors that Influence a Bond's Duration?

Remaining maturity

The longer a bond's remaining maturity is, the higher its duration.

Coupon rate

Coupon rate and duration are inversely correlated. The higher a bond's coupon rate, the lower its duration.

How to Interpret a Bond's Duration

Mathematically speaking, Macaulay duration measures the average duration to reception of a bond's cash flows. This information alone is of no great value. It does however also provide a first approximation of the price variation for a change in yield by 1% (100 basis points).

It should be noted that, although duration provides a rather precise estimation for price variations caused by limited yield changes, its precision is a lot lower when dealing with large yield changes. The reason for this is the convexity of bonds' price-yield curves.

Because of this lack of precision, Macaulay duration is not used as an indicator of credit risk by market professionals. The latter turn more towards the modified duration, the calculation of which is based on Macaulay duration, but incorporates convexity.

The Modified Duration of a Bond

What is the Modified Duration of a Bond?

Modified duration is derived from Macaulay duration and based on the calculation of the latter. It expresses the price change for bond as a consequence of a variation of 1% in its yield. It is measured as a percentage of the price.

How is the Modified Duration of a Bond Calculated?

Point on the formula to see its legend

This formula can be used to calculate the variation of the price of a bond following a change in its yield of any amplitude by applying it into the following expression:

\( \Delta P = -D_{mod} \times \left(\Delta r \right ) \times P \)

What are the Factors that Influence a Bond's Modified Duration?

The factors which influence modified duration are the same as the ones which impact Macaulay duration.

The Convexity of a Bond

What is the Convexity of a Bond?

Convexity describes the fact that the graph representing the relationship between a bond's price and its yield is not a straight line, but a curve.

This means that the variation in price induced by a change in yield will be of a different amplitude, depending on which point of the curve is looked at.

What are the Characteristics of a Bond's Convexity?

The longer a bond's remaining lifetime, the higher its convexity.

The bond's coupon rate and its convexity are also positively correlated.

How is the Convexity of a Bond Calculated?

A bond's convexity can be calculated using the following formula:

Point on the formula to see its legend

In order to calculate the actual effect of convexity on price change however, the following formula is used:

Point on the formula to see its legend

What are the Applications for the Convexity of a Bond?

The calculation of convexity provides the adjustment to be applied to duration in order to dispose of a more accurate result, particularly in case of an important yield variation. The greater the yield variation, the higher the convexity adjustment will be.

The Price Value of a Basis Point (PVBP)

What is the Price Value of a Basis Point (PVBP)?

PVBP indicates the price change for a variation of one basis point in the bond's yield. Unlike modified duration, PVBP expresses the price change not as a percentage but in currency. It is often found under the name of DV01 (Dollar Value of an 01), especially in Anglo-Saxon markets.

How is the Price Value of a Basis Point (PVBP) Calculated?

PVBP can be deduced from modified duration as shown hereafter:

Point on the formula to see its legend

Conclusion

The analysis of a bond as outlined above allows evaluating risks an opportunities and thus making informed investment decisions. It also provides important information for hedging these risks or for defining and setting up trading strategies.

The partial or complete elimination of interest rate risk can be obtained through the use of interest rate swaps, interest rate futures or an offsetting bond position, where the two latter will be primarily used by market participants with a short investment horizon, like bond traders.